Car insurance, simplified

Quick quote

Get a personalized quote in minutes and customize your coverage according to your needs. From there, you can checkout online instantly!

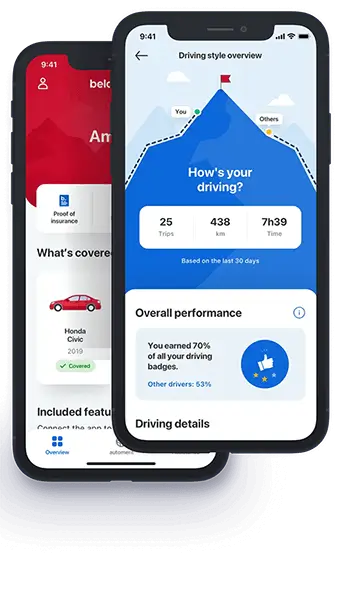

Easy access

Manage your insurance anytime with the belairdirect app. You also get access to free perks that help you save money and stay safe on the road.

Speedy claims

Submit a car insurance claim in minutes through the belairdirect mobile app or online. Then, track your claim until it’s been resolved.

Great prices

Get the best deal on your car insurance with competitive rates and lots of discounts. See how much you could save with belairdirect!